Disclosure

Managed Algo Trading is owned and operated by Open Channel Media LLC. ManagedAlgoTrading.com is not a registered Commodity Trading Advisor (CTA), broker, or investment advisor. We do not manage customer accounts, give trading advice, or execute trades. We are the developers of a systematic S&P 500 futures strategy and license it to qualified individuals through registered brokers. All brokerage and trading services are handled exclusively by licensed professionals.

As stated above, you are purchasing a subscription-based software license for our algorithmic trading system. ManagedAlgoTrading.com is a software developer only. All account opening, funding, and trade execution are handled exclusively by properly licensed and registered futures professionals, independent of us. We receive a flat licensing fee only and do not receive commissions, rebates, or compensation of any kind from brokers, execution facilitators, or trading activity.

Risk Disclosure

Trading futures involves substantial risk of loss and is not suitable for all investors. You can lose more than your initial investment. Only risk capital — funds you can afford to lose without affecting financial security or lifestyle — should be used. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure (CFTC Rule 4.41)

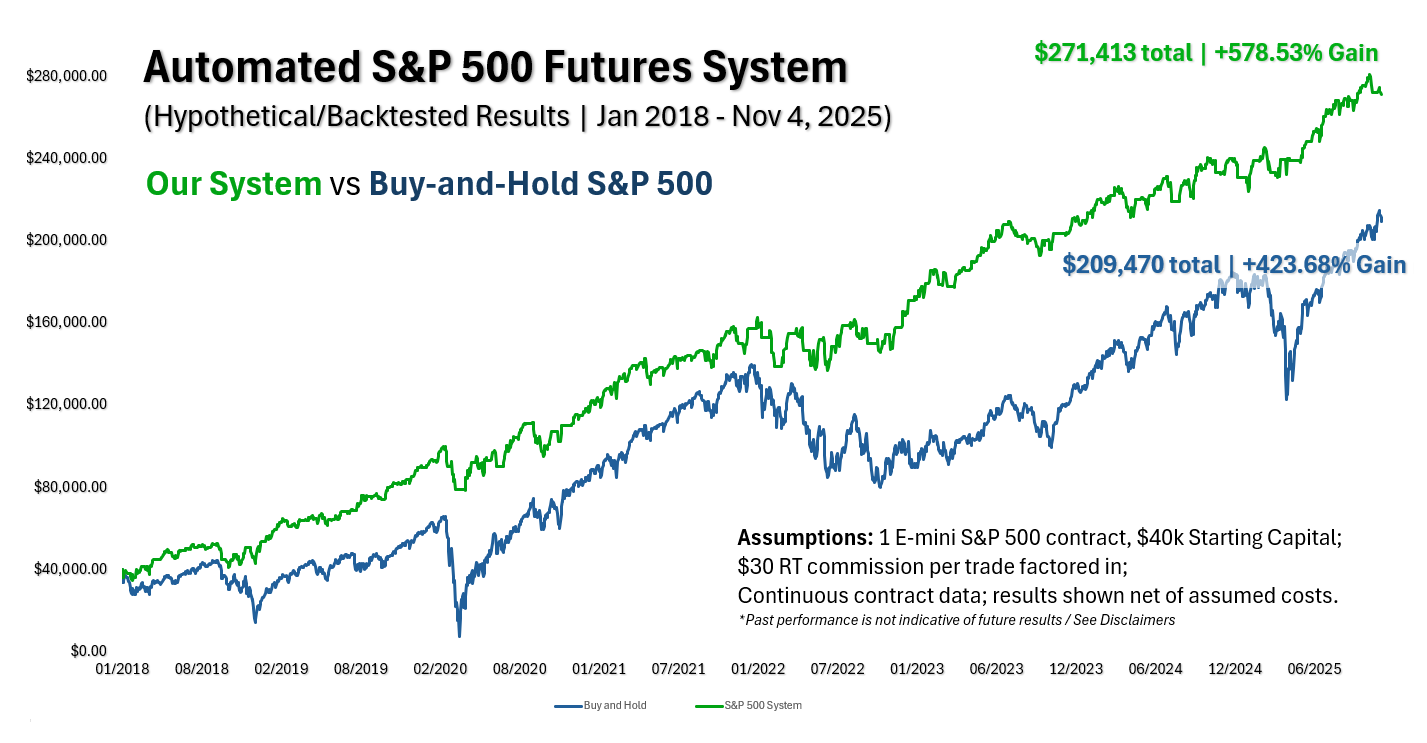

The performance results shown are hypothetical/backtested and have inherent limitations. Unlike an actual performance record, they do not represent real trading. Because trades were not actually executed, the results may have over- or under-compensated for market factors such as liquidity. Hypothetical results are prepared with the benefit of hindsight and do not involve financial risk. No hypothetical record can fully account for the impact of financial risk in actual trading, including the ability to withstand losses or adhere to a program in the face of drawdowns.

No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Actual trading results will differ materially.

See our Risk & Liability Disclaimer / Terms and Conditions of Use, Privacy Policy